Digital Asset Regulation – Part 4

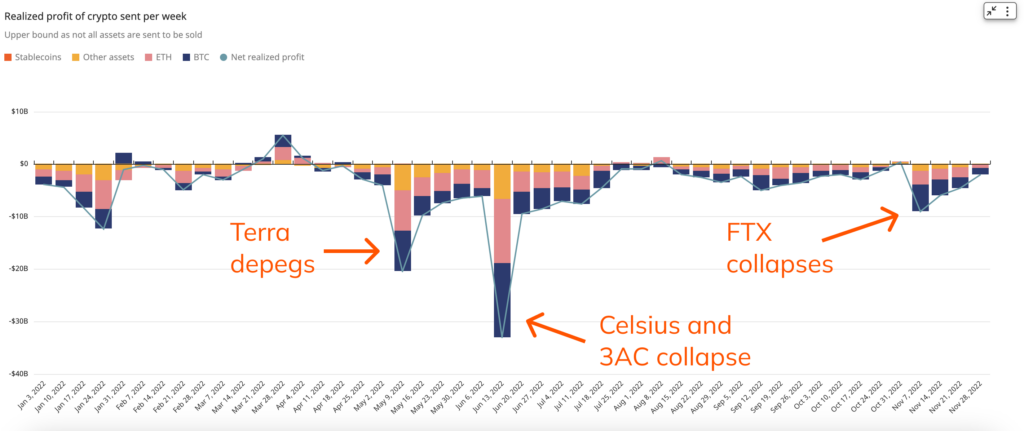

Last year saw at least three high-profile blow-ups in the cryptoasset space (all sourced here):

- The demise of FTX (investors are currently estimated to have lost $9 billion)

- The de-pegging of Terra’s UST token (losses estimated at $21 billion)

- The collapse of the Celsius platform and of Three Arrows Capital (losses estimated at $33 billion)

In April 2022, HM Treasury went on the record to make the UK a cryptoasset hub, including announcing plans to regulate stablecoins (like Terra LUNA) and more recently as discussed in yesterday’s piece by the BBC (link).

Regulatory response

As a consequence of Brexit, the UK government published the far-reaching Financial Services Framework whereby all retained EU law will be reviewed, repealed, reformed and replaced over the next few years (link). But an essential element of this framework is the Financial Services and Markets bill, which is making its way through Parliament. There are specific provisions in the FSMB targeting cryptoassets and cryptoasset service providers (link), presumably partially in response to all known crypto debacles and especially those of 2022.

Back to the scandals of 2022 and a comparison

Blockchain analysis firm Chainalysis has very helpfully produced this graph to give a sense of scale:

These are massive numbers, but bear in mind that the Global Financial Crisis of 2008 is estimated to have led to losses of about $10 trillion, according to UK think tank Chatham House (link). Even over-estimating them at $100 billion, the 2022 crypto blow-ups are 1% of losses from the GFC. In response to the GFC, regulators globally stepped up to quell concerns by passing myriad pieces of legislation designed to prevent further catastrophic loss to everyday people’s livelihoods and savings, as well as to protect corporate donors such as multi-national financial institutions.

We at GDFM are hopeful that the UK government, HM Treasury, the FCA and the PRA will promulgate and pass sensible legislation and regulations that take into account crypto’s nuances, do not crush innovative finance by over-reacting to that 1% and that protect consumers.

Read Part 1 here.

Read Part 2 here.

Read Part 3 here.